indiana real estate taxes

Pay Your Property Taxes. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes.

State And Local Tax Collections State And Local Tax Revenue By State

Enter your last name first initial.

. This figure is slightly lower than the national average. Please direct all questions and form requests to the above agency. The information provided in these databases is public record and available through public information requests.

Taxes involved in Bankruptcy. Taxes can be divided into two annual installments with one being. Provides that for each calendar year beginning after December 31 2021 an annual adjustment of the assessed value of certain real property must.

Conduct Annual Tax Sale pursuant to Indiana Statute. In order to calculate your tax bill your net assessed value is multiplied by your local tax rate of 07090. How Property Taxes Work in Indiana.

Property taxes in Indiana are paid in arrears meaning the taxes paid in the current year represent the taxes owed for the previous year. Generally a sweeping appraisal technique is used with that same methodology applied across the board to similar. Tax deadline for 2020 realpersonal taxes.

For mortgages that were recorded prior to December 31 2022 residents will still be able to apply for the mortgage deduction on taxes payable in 2023 however the deduction will. Go to httpwwwingovmylocal and. You can search the propertyproperties by.

2019 pay 2020 property taxes are due May 11 2020 and November 10 2020. In Indiana tax rates are calculated on a per 100 basis. The exact property tax levied depends on the county in Indiana the property is located in.

Choose from the options below. CREDIT SCORE BASED Low to Excellent -- These are competitive rate loans based on your. Taxes in Indiana are due annually in 2 installments due in.

Property tax increase limits. There are various loans available to assist you with paying your delinquent property taxes. Statements are mailed one time with a Spring A coupon and Fall B.

In Indiana there is an annual property tax of only 1200. Billing and Collections of Property taxes Real Estate Personal and Mobile Homes. The Department of Local Government Finance has.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. The Indiana Department of Revenue does not handle property taxes. The Department of Local Government Finance DLGF in partnership with the Indiana Business Research Center IBRC at Indiana University created the below tax bill.

155 Indiana Avenue Valparaiso Indiana. Indianas statewide average effective real estate tax rate is. Building A 2nd Floor 2293 N.

In Indiana aircraft are subject to. Please contact your county Treasurers office. Indiana laws prescribe new property assessments on a recurring basis.

Real estate owners in the state of Indiana must pay taxes on their property every year. The state Treasurer does not manage property tax. The exact number you pay will depend on where you live but overall Indianas real estate tax is among the lowest in the country.

Hamilton County collects the highest property tax in Indiana levying an average of 227400. Main Street Crown Point IN 46307 Phone. Welcome to the St.

Joseph County Tax research information. If you have an account or would like to create one or if you. This means that for every.

Signup to get updates in your email from the state. The average effective property tax rate in the state is 81.

Marion County Indiana Property Tax Appeal

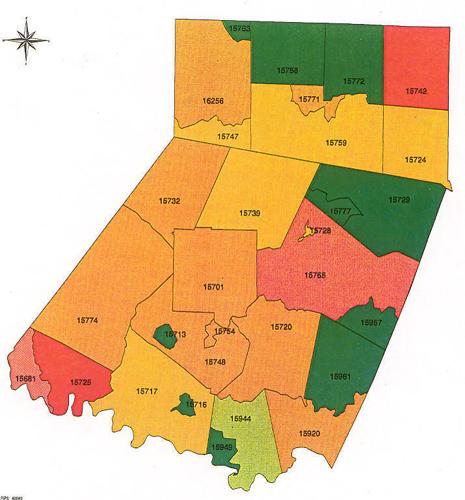

Commissioners Discuss Real Estate Taxes Name Stakeholders Local News Indianagazette Com

See How Low Property Taxes Are In Indiana Wane 15

Here S A Reminder That Indiana Property Taxes Are Due May 10 Eagle Country 99 3

How We Got Here From There A Chronology Of Indiana Property Tax Laws

South Bend Property Taxes Realst8 Com Real Estate And Area Information For South Bend Mishawaka Granger And Notre Dame Indiana

Property Tax In The United States Wikipedia

Indiana Property Tax Calculator Smartasset

The New Age In Indiana Property Tax Assessment

Pay Your Property Taxes Or View Current Tax Bill

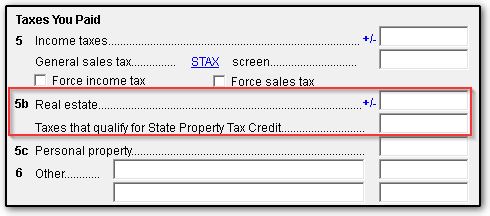

Indiana Property Tax Deductions Are You Getting All Yours The Derrick Team 317 563 1110

Indiana Property Tax Calculator Smartasset

Clark County Indiana Treasurer S Office

Berkshire Hathaway Agent Hoping To Lure Cook County Homeowners To Northwest Indiana Crain S Chicago Business

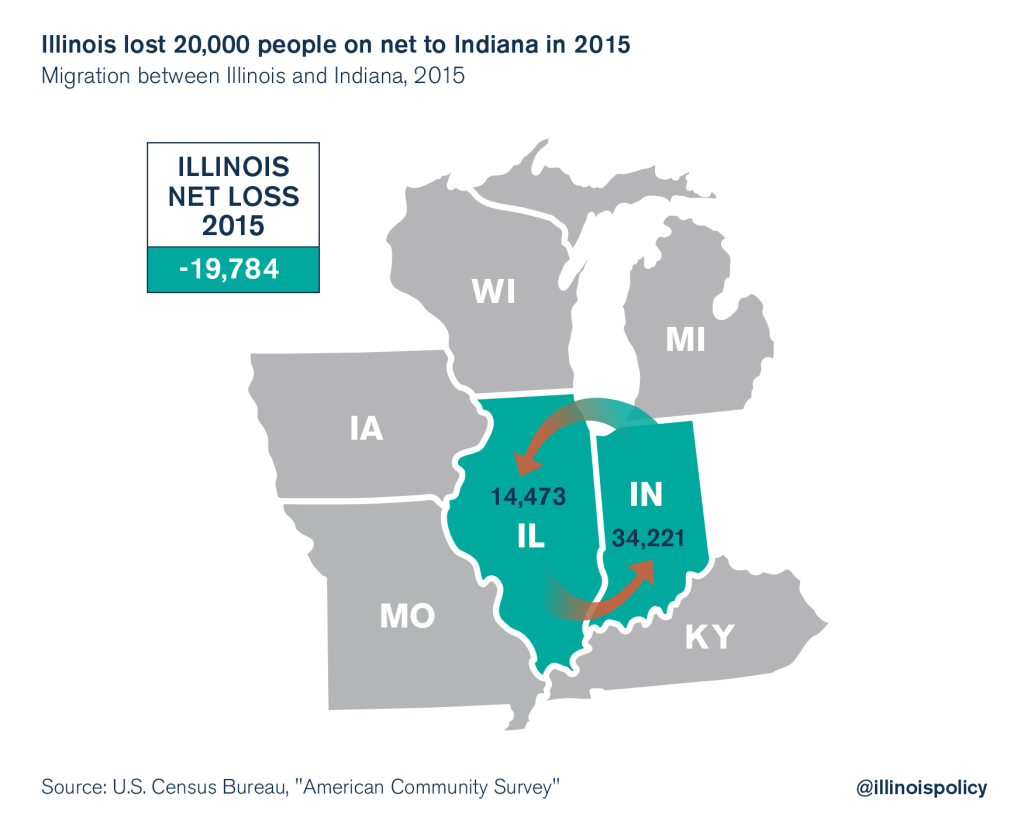

Illinois Has Higher Property Taxes Than Every State With No Income Tax